During the weekend, new news broke out in the market. It was reported that a TDI factory in Shanghai failed to restart the device on Friday and could not restart as planned, and the source described the situation as serious.

The plant's 160000 T / a TDI unit shut down unexpectedly in the middle of the year, which was an unplanned shutdown after news said it would last for three weeks.

Due to the previous unscheduled parking, it is reported that the current low inventory supply of the factory is tight. Zhuo Chuang expects that the factory will eliminate the fault as soon as possible to realize the restart and guarantee the supply. However, the specific progress is still uncertain and unpredictable. It is suggested that all parties should pay close attention to it.

At present, it is impossible to determine the clear impact and duration of the incident. However, according to the description of "serious" by the sources and the fact that the factory has low inventory due to the previous accidental shutdown, it is expected that its supply situation in the short term is worrying, and its direct supply to users and distributors has the risk of reduced supply. The perspective is placed in the industry. At present, the inventory situation among TDI factories is quite different. It is expected that those with high inventory will comply with the market trend on the premise of practicing the shipping idea, while those with low inventory may take advantage of the situation to moderately shrink supply and balance demand.

In the previous three months, the demand side did not actively purchase most of the time, only a small amount of replenishment was made at 2-3 nodes, most of which consumed the previous stock. However, after nearly three months of consumption, the stock of raw materials of the vast majority of users has been greatly reduced.

According to the sample survey of Zhuo Chuang, most large and medium-sized users have reduced their reserve TDI from the most abundant level of 12-16 weeks to 3-6 weeks in addition to the monthly contract volume. However, the huge reserves of small and micro users in the first half of the year, after long-term consumption, have also dropped significantly. The TDI stock of some sampled users has dropped from the most abundant 5-8 months to 5-9 weeks.

In the process of price decline, the willingness of users to replenish the warehouse gradually increased. After Zhuo Chuang communicated with the user and tracked the market, when the price was close to 12000 yuan / ton, some users began to start the purchase plan, but the psychological price of large and medium-sized users to start large goods was lower.

Before the Spring Festival, customers will inevitably have one or more rounds of purchase reserves, which will be subject to market changes. Most users say that if the price continues to decline, they will enter the market for stock preparation according to the plan. If the market goes up unexpectedly, most users may return to the form of consuming stock and relying on contracts, and temporarily give up the reserve of large goods.

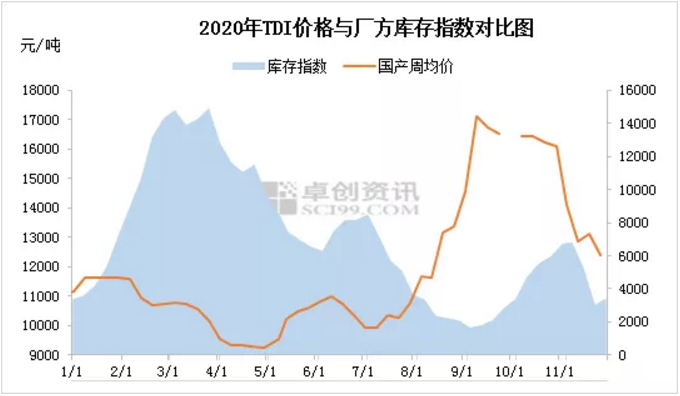

In terms of the market, after the trading volume and rebound on the 13th of the month, TDI failed to continue to rebound and realize reversal. Instead, it entered the form of negative loss again and fell back to the previous low point. At the end of the month, the spot price of domestic products in East China was 12200-12300 yuan / T, which was basically the same as the low in the middle of the month.

After entering November, there was less good news in TDI market. In terms of devices, in addition to the planned maintenance of kosstro, Shanghai BASF stopped unexpectedly in the middle of the year. The supply of the above-mentioned factories shrank correspondingly, and there were strong willingness and expression in terms of price. Other factories have different reactions to this, and some of them echoed. During the large-scale order receiving on the 13th, they controlled the quantity and cut down the orders, and the subsequent settlement price was considered high by most people in the market. Some factories did not respond positively to this news, but chose to close the market price and open the supply. Some factories also actively closed to the market price and offered a buy it now price.

These different operations between factories failed to form a consistent force. However, in the trading market, the positions of the mainstream primary market in November are quite different. Most of the mainstream businesses hold high cost and many orders, and bear great pressure in the downward trend, and only a few of them are in the state of light position and low pressure. Therefore, under the background of factories failing to keep pace with each other, it is difficult for the trade market to form a joint force. In November, the factory side and the mainstream first-hand merchants almost lost their initiative, and the second-hand market took the initiative to lead the decline in the market price, and the non purchase of the user side exacerbated the continuous price decline.

In November, TDI East China domestic goods decreased by 2250 yuan / ton or 17.3% from 14800 yuan / ton at the beginning of the month to 12250 yuan / ton at the end of the month.

With the price entering 12500 yuan / ton again, the market sentiment gradually began to differentiate. First of all, there is a general tendency among bulls. When the price is lower than 12000 yuan / T, the willingness to ship is very small, and the willingness to put into storage is improved. Most of them say that if the price continues to go down, they will gradually purchase and enter into the idea of warehouse building. At the beginning of late November, some futures in January of the following year had a discount of 1000 yuan, and showed a positive willingness to supply. With the spot market entering below 12500 yuan / ton, short positions also correspondingly contracted supply and moderately tightened the discount operation. From the perspective of users, although the high price of polyether in the early stage seriously restricted users' access to the raw material market, TDI's return to less than 12500 yuan / ton still attracted the attention of users, and the inquiries about when to copy the bottom price increased significantly.

Previously, Zhuo Chuang believed that after TDI entered 12500 yuan / T, the decline would effectively slow down and the falling space might only be more than 1000 yuan. However, under the background of weekend emergencies, the risk of subsequent deep decline of TDI was greatly reduced, and it is even hoped to help the market to build a bottom and stabilize. With the support of other good news or positive attitude of the factory, the rebound market is expected to be realized. In addition, the medium and long-term market still depends on the comprehensive output of the industry, the supply willingness of most manufacturers, and the market purchasing activity.