News fast food for commodity people

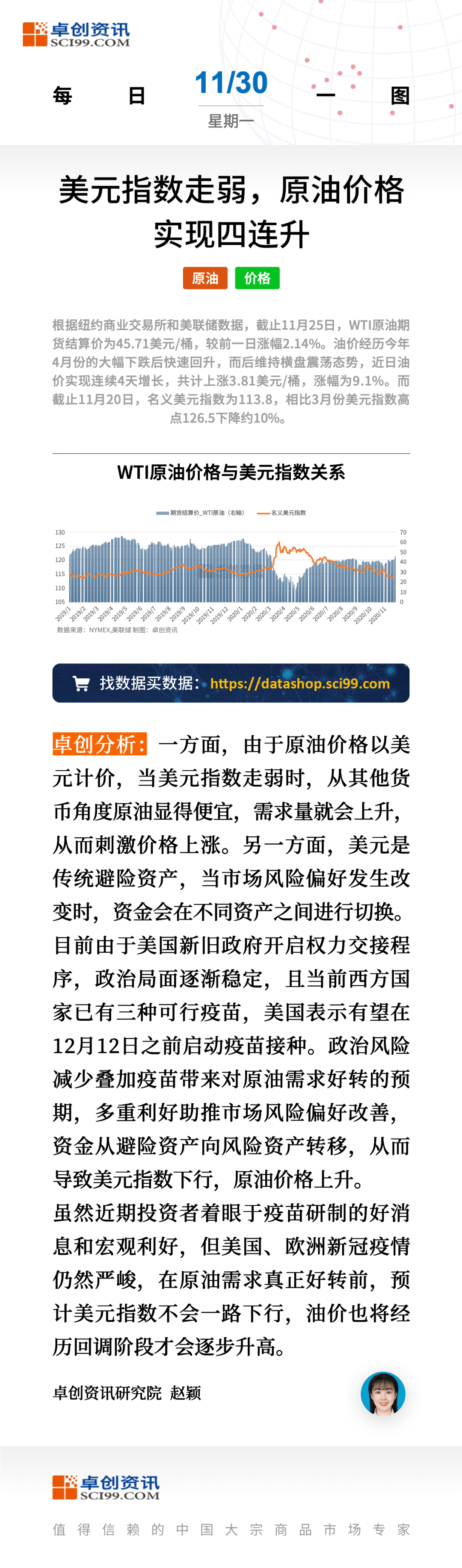

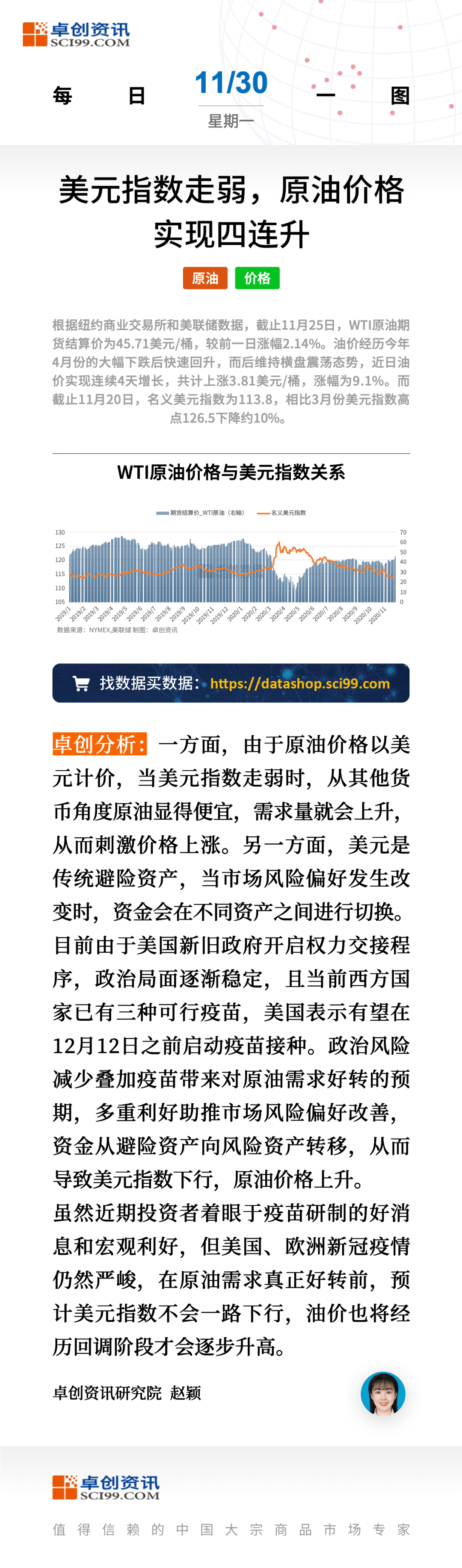

[chart of the day: US dollar index weakens, crude oil price rises for four consecutive times

[macro cycle: replenishment cycle has started]

[macro economy: total profits of industrial enterprises have changed from negative to positive year on year]

[energy OPEC: postponement of production reduction is uncertain, oil price is adjusted at a high level in stages]

[crude oil supply: geopolitical uncertainty increases, crude oil supply worries]

[crude oil supply: OPEC + failed to reach agreement on postponement of production increase before the full meeting]

[chemical industry: from January to October, the total profit of chemical raw materials and chemical products manufacturing industry increased by 2% year-on-year]

Salary agreement with Canaria copper workers

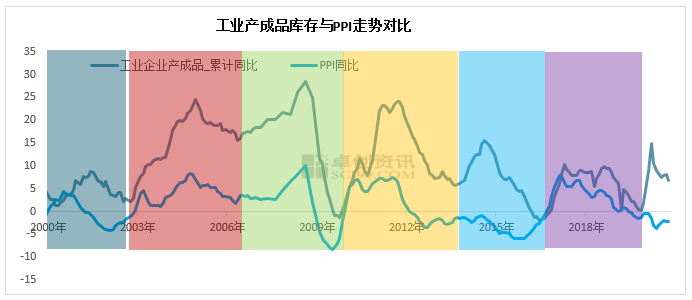

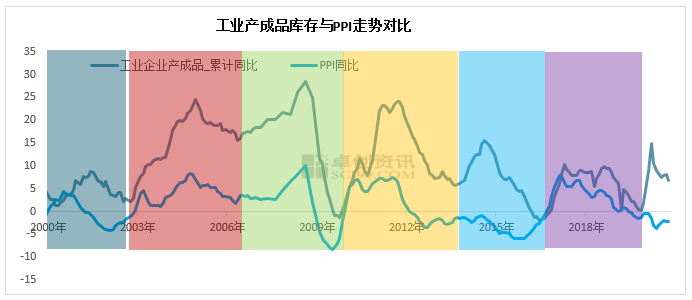

[macro cycle: replenishment cycle has started]

By the end of October, the inventory of industrial finished products has increased by 6.9%, a new low this year, with PPI down 2.1%. From the data structure, the current inventory cycle is still in the state of replenishment, but the starting mode of the inventory cycle is quite different from that in the past.

Zhuo Chuang analysis: since 2000, the seventh wave of inventory cycle has been started, but the characteristics of inventory cycle are quite different from those in the past. In the replenishment stage, the price of industrial metals and crude oil performed better, which can be seen from the recent price performance of copper and other products, but the performance of crude oil price was slightly worse. Based on the cyclical consideration, we are optimistic about the price trend of industrial metals and crude oil in the medium term. (Liu Xinwei, Zhuo Chuang Information Research Institute)

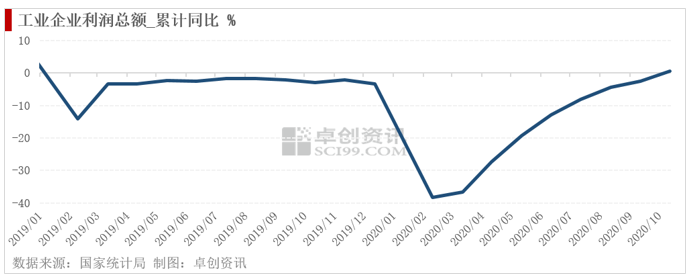

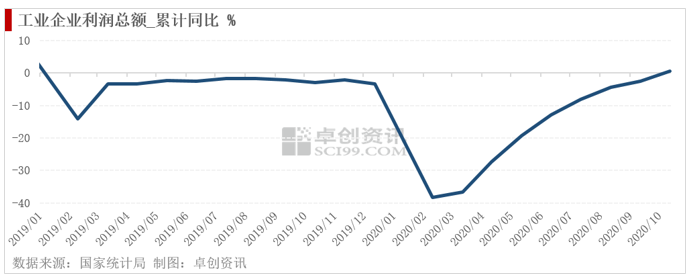

[macro economy: total profits of industrial enterprises have changed from negative to positive year on year]

According to the data of the National Bureau of statistics, from January to October, the total profits of Industrial Enterprises above Designated Size reached 5012.42 billion yuan, with a cumulative year-on-year increase of 0.7%, and a decrease of 2.4% from January to September. The year-on-year growth rate of accumulated profits turned from negative to positive for the first time.

Zhuo Chuang analysis: in October, the profit of Industrial Enterprises above Designated Size reached 642.91 billion yuan, a year-on-year increase of 28.2%, while in September, the figure was 646.43 billion yuan, with a year-on-year increase of 10.1%. There was no significant difference between October and September in the total profit of Industrial Enterprises above designated size. The cumulative year-on-year change from negative to positive was mainly due to the low base in October last year. In addition, since March this year, the accumulated profits have been steadily improving year on year, indicating that the market supply-demand relationship is improving day by day, and the demand is improving, which stimulates the enterprises' profits to recover.

At the same time, many industries have the phenomenon of "active replenishment". For the bulk commodity industry, this is undoubtedly a good thing. The strong recovery of the demand side makes the price and volume of enterprises in the middle and lower reaches rise simultaneously, and the profits increase. Then, the price of bulk commodities has been repaired to varying degrees. (Zhao Ying, Zhuo Chuang Information Research Institute)

Industry express

[energy OPEC: postponement of production reduction is uncertain, oil price is adjusted at a high level in stages]

The OPEC + group meeting failed to make a final decision on the cut in production, leaving the suspense at the final meetings on November 30 and December 1, Reuters reported.

Previously, the crude oil market had strong expectations for the postponement of OPEC + production reduction agreement from the first quarter of next year to the second quarter. Although it could not be said that the "boots landed", at least more than half of them were released. In recent days, risk indicators have fluctuated dramatically: gold fell from 1870 to 1780, WTI rose from $39 to $45, and the US dollar index fell to its lowest level since April 2018. Matthew hornbach, chief Macro Analyst at Morgan, believes that central banks will start a new round of easing in 2021 and liquidity will be more rampant. In the near future, whether OPEC + can postpone the agreement on production reduction or the risk increase in the Middle East caused by unexpected events in Iran will aggravate the fluctuation of crude oil market. However, it is surprising that the crude oil market has always maintained a "calm" attitude. From the equation of MV = PQ, it seems that "P" is now anchored on M, reflecting that macro-economy has become the leading force of oil price in the near future. As asset prices rise to record highs in the expectation of increased liquidity, capital risk appetite will certainly reverse. Inflation driven price rise risks are hidden in the anti inflation and essential goods markets represented by gold and crude oil. (Zhao Ning, Zhuo Chuang Information Research Institute)

[crude oil supply: geopolitical uncertainty increases, crude oil supply worries]

On the afternoon of November 27 local time, a top Iranian nuclear scientist was attacked and assassinated. The next day, in condemning the act, the Iranian president vowed to take revenge. Subsequently, the Pentagon announced that it had dispatched the aircraft carrier Nimitz to the Persian Gulf.

More than half of the world's oil resources are stored along the Gulf Coast. At the same time, more than one-third of the world's crude oil trade needs to pass through the Strait of Hormuz, the "throat of oil transportation". Historically, whenever there is a geopolitical conflict in Iran, global concerns about the supply of crude oil transport have intensified. The market is looking forward to whether the upcoming jmmc meeting will delay the production increase, and the increasing geopolitical uncertainty has also exacerbated the tension on supply. However, at present, Iran has not announced specific retaliation measures, and the impact on crude oil transportation supply is still uncertain. (Zhao Bowen, Zhuo Chuang Institute of information technology)

[crude oil supply: OPEC + failed to reach agreement on postponement of production increase before the full meeting]

In the informal online discussion held last Sunday night, most participants supported maintaining the current production restriction level until the first quarter. Although Russian Deputy Prime Minister Alexander Novak supported the postponement of production increases currently scheduled for the start of the new year, the UAE and Kazakhstan voiced opposition.

Although it is widely expected that the OPEC + ministerial meeting to be held on Monday will postpone the production increase plan to start in January next year, the informal meeting held earlier last weekend showed that some countries expressed opposition. After all, for some OPEC + members whose crude oil exports account for a large proportion of GDP, low oil prices and production cuts have caused heavy losses to their economies. However, in the current state of low demand and no further rise of price center, violating the quota agreement can only relieve the pressure of funds in a short period of time. Oil price is lower than the cost of financial profit and loss, so the increase of production is undoubtedly a poison to quench thirst, and it is not an act of maximizing economic interests. Therefore, compared with the high oil price period, the current low oil price tends to unite the Member States, and the OPEC + rate will delay the production increase plan. (Zhao Ying, Zhuo Chuang Information Research Institute)

[chemical industry: from January to October, the total profit of chemical raw materials and chemical products manufacturing industry increased by 2% year-on-year]

According to the data released by the National Bureau of statistics on November 27, the total profit of the chemical raw materials and chemical products manufacturing industry was 302.98 billion yuan from January to October, an increase of about 2% over the same period last year. This is the first time since this year that the total accumulated profit has achieved a year-on-year positive growth.

Zhuo Chuang analysis: driven by the recovery of demand side, chemical raw materials and chemical products continued to rise from July. At this stage, social inventory continued to digest. In September and October, under the stimulation of the traditional consumption peak season and the return of some overseas orders, the prices of chemical raw materials and chemical products accelerated, and the prices of some products represented by polyurethane and engineering plastics were created for many years New high. In this stage, the crude oil was mainly horizontal finishing, the price fluctuated around $40 / barrel, and the cost side changed little, so the profits of chemical raw materials and chemical products manufacturing industry continued to improve. (Li Xunjun, Zhuo Chuang Institute of information technology)

Salary agreement with Canaria copper workers

Chile's Candelaria copper mine union said Friday it had accepted a new 35 month collective agreement from Canada's Lundin mining company. The move follows a month long strike at the mine.

Chile is the world's largest copper producer with an annual copper output of 5.7874 million tons in 2019. Candelaria copper mine produces 111400 tons of copper in 2019, accounting for about 2% of Chile's copper production. In October this year, the supply side disturbance of Escondida copper mine and Candelaria copper mine in Chile once led to a sharp rise in copper prices. Since mid November, the supply constraints of the two mines have been gradually lifted and the production has returned to normal. However, at the macro level, the nominal interest rate remains low and inflation expectation goes up. Copper can play a stronger financial attribute. As inflation rises, the price will continue to rise, and it is expected to maintain a higher price range. (Zhao Ying, Zhuo Chuang Information Research Institute)